Take Control of Your Credit in as Little as 45 Days

Build Your Credit. Reshape Your Future

Premium, transparent credit restoration services

Hi, I’m Artie Perez, founder of The Credit Connect. I know firsthand how powerful credit can be—because I had to rebuild mine from the ground up.

At one point, my credit score sat in the 400s, and the weight of debt felt overwhelming. Denials, limited options, and constant financial pressure became the norm. I made the decision that poor credit would not dictate my future.

By learning how credit truly works and applying disciplined, lawful strategies, I was able to restore my credit profile and achieve an excellent credit standing in under a year. That transformation opened doors I once believed were closed—allowing me to remove financial roadblocks, create stability, and leverage credit responsibly in real estate and business opportunities.

What sets me apart is experience. I’m not speaking from theory or a textbook—I’ve lived the frustration, uncertainty, and stress that come with damaged credit. And I’ve also experienced the relief and confidence that come from regaining control.

Today, The Credit Connect exists to help individuals correct inaccuracies on their credit reports, understand their financial position, and move forward with confidence.

My commitment goes beyond credit repair—I focus on education, long-term strategy, and empowerment.

In addition, I mentor driven entrepreneurs who want to build ethical, compliant, and sustainable businesses within the credit services industry.

Through coaching and education, I help others create independence, impact, and lasting success. If you’re ready to take control of your credit and start building a stronger financial future, I’m here to guide you—step by step. Your journey starts here.

WHAT WE DO

Fix Errors. Boost Scores. Regain Control.

Dispute inaccuracies, remove harmful items, and rebuild a healthier credit profile.

Grow Your Credit the Smart Way.

Use proven strategies, tradelines, and responsible credit habits to steadily increase your score.

Build Credit for Your Business — Separate from Personal.

Establish business profiles, get vendor accounts, and unlock higher credit limits.

Get Funding-Ready in Weeks, Not Months.

We help you structure your credit, documents, and profile to qualify for loans, lines of credit, and grants.

HOW IT WORKS

Create your account and choose the plan that fits your goals.

Securely upload your credit reports for review.

Our team challenges inaccuracies and negative items on your behalf.

Track improvements and get ongoing guidance every step of the way.

A FREE 15 MINUTES CONSULTATION CALL

Consultations are completely optional—many of our clients join without ever booking a call because our results and reviews speak for themselves.But if you’d like answers before getting started, we’ve made it easier than ever to connect with our team!

- Questions about repairing your credit?

- Curious about our mentorship opportunities?

- Want to learn how we’ve already transformed thousands of lives?

This is your chance to get clarity, confidence, and direction—in just 15 minutes with our expert team. —No charge, no excuses.

CHOOSE YOUR PRICING PLAN

⚡ Immediate Credit File Review

Your personal credit reports are pulled, reviewed, and analyzed as a priority to identify inaccurate, outdated, or unverifiable items.

📁 Hands-Off Dispute Handling

Every dispute is professionally drafted, documented, and submitted on your behalf.

🔁 Accelerated Dispute Cycles

Strategic dispute rounds are launched with a focus on speed and efficiency.

🏛 Federal-Level Submissions

CFPB disputes ensure credit bureaus respond under federal oversight.

Best for:

• Individuals who want fast, focused action

• White-glove solo service

⚡ Dual Credit File Processing

Two separate credit profiles are reviewed simultaneously so both individuals progress together.

📁 Coordinated Dispute Management

Each individual receives personalized documentation while submissions run in parallel.

🔁 Parallel Dispute Rounds

Dispute cycles are aligned across two profiles without slowing progress.

🏛 CFPB Oversight for Both

Federal-level submissions ensure compliance and accountability for each bureau.

Best for:

• Couples & spouses

• Joint financial planning

• Shared credit goals

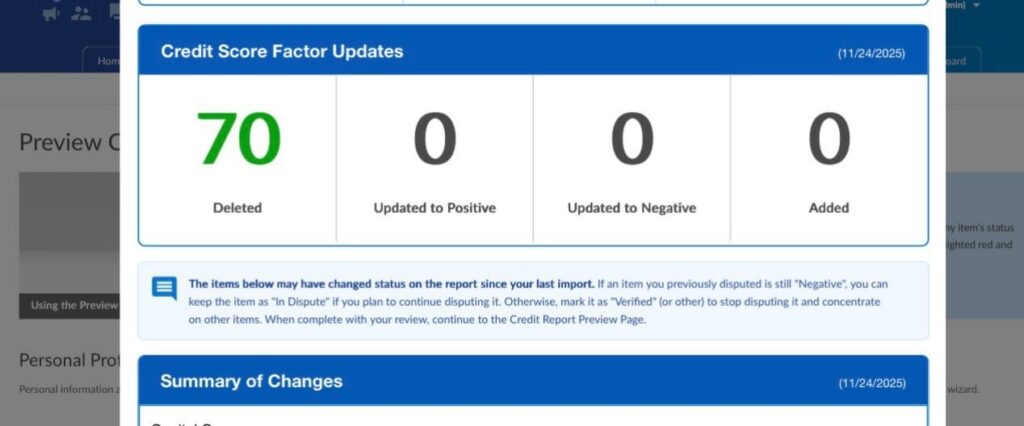

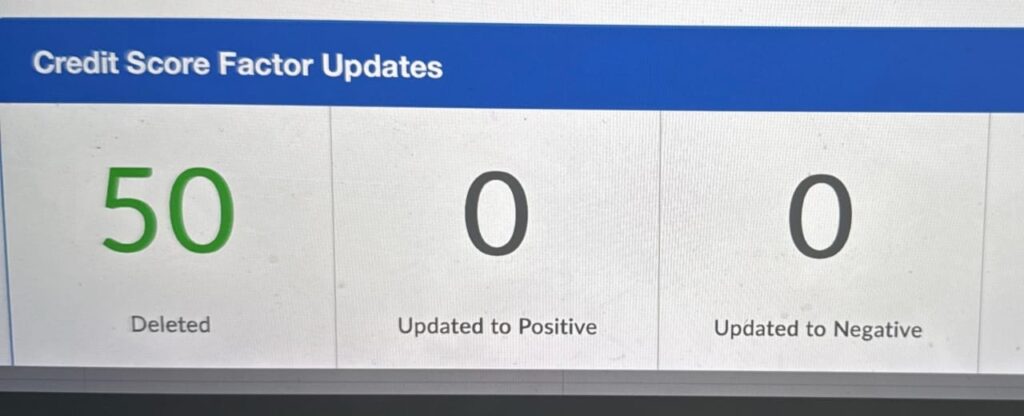

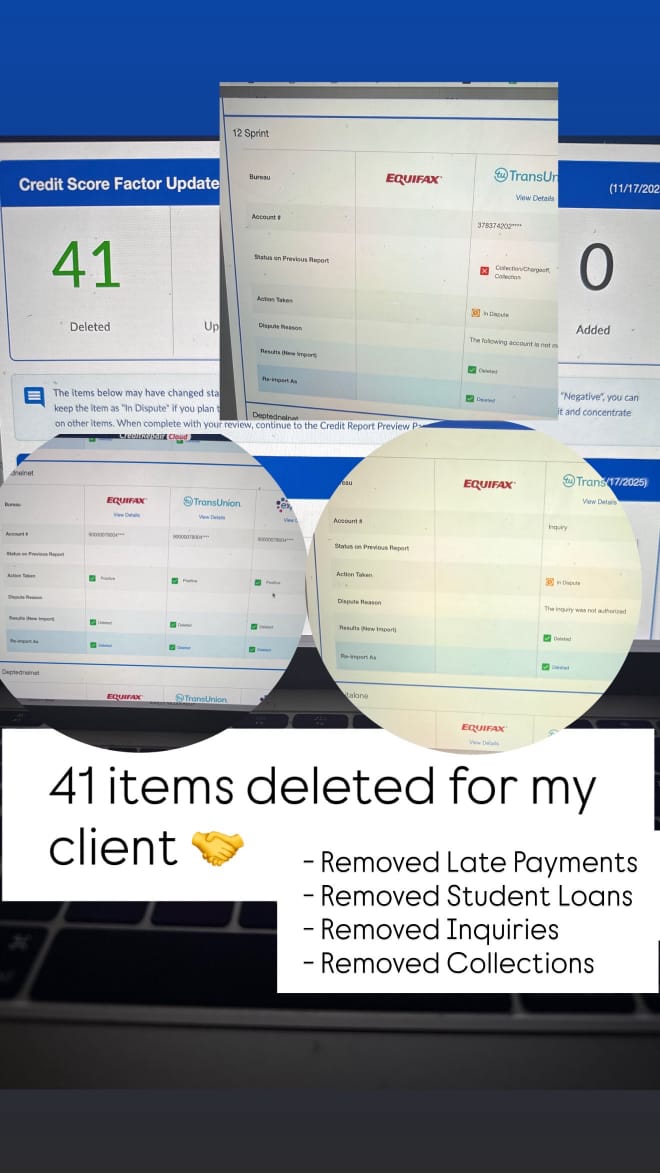

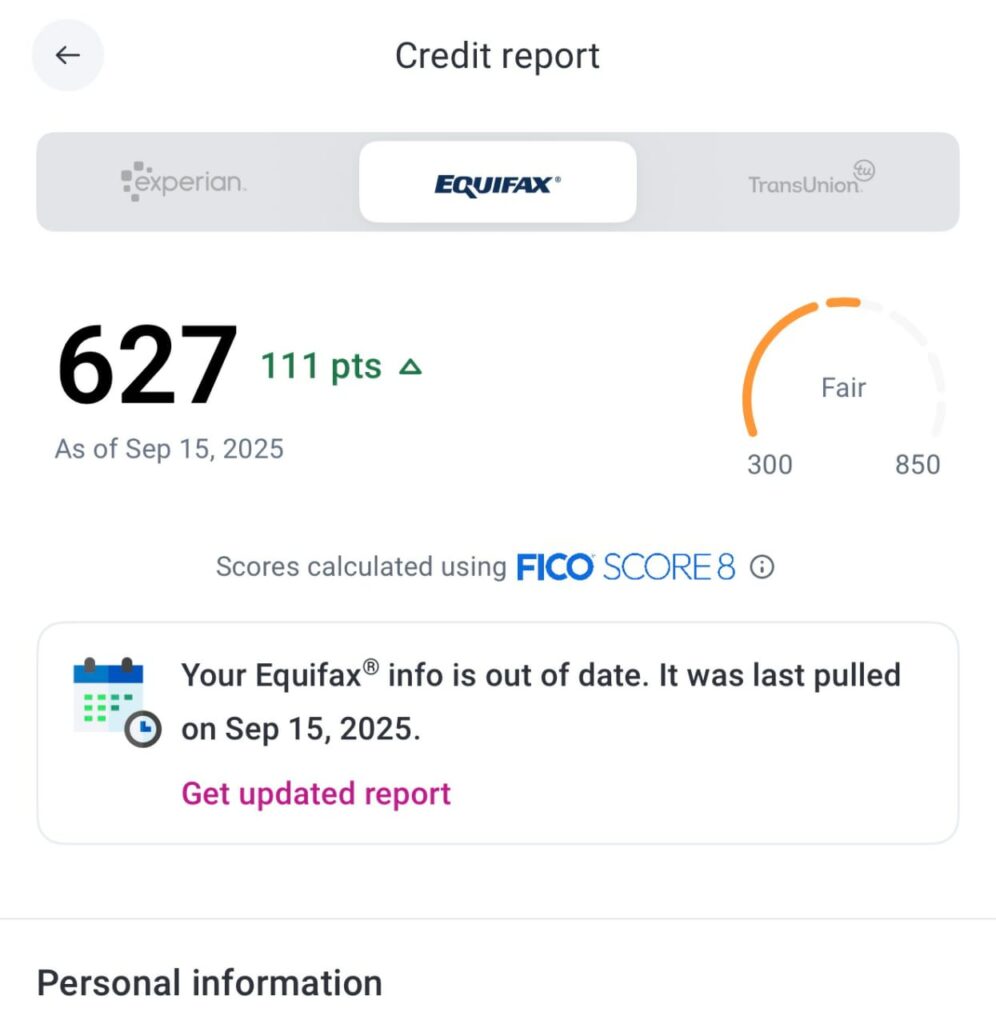

PROVEN RESULTS

FREQUENTLY ASKED QUESTIONS

What is The Credit Connect?

The Credit Connect is a professional credit education and credit repair service designed to help consumers

identify and address inaccurate, incomplete, outdated, or unverifiable information appearing on their credit

reports. We guide clients through a structured, compliant dispute process while providing education to

support long-term credit health.

Our mission is not just correction — it’s clarity, confidence, and control over your credit profile.

How does your credit repair process work?

Credit repair timelines vary based on individual credit profiles. Some clients may see changes within 30–90

days, while others may require several months or longer.

Factors that impact timing include:

- The number of negative items

- The type of accounts involved

- Creditor and bureau response times

No specific results or timelines are guaranteed.

How long does credit repair take?

Most clients begin seeing results within 30–45 days, but full credit restoration may take 3–6 months, depending on the complexity of the credit issues.

What items can you remove from my credit report?

We work to dispute information that may be:

- Inaccurate

- Incomplete

- Outdated

- Unverifiable

This may include:

- Late payments

- Collections

- Charge-offs

- Certain public records

- Identity theft-related

accounts - Inquiries (when applicable)

Accurate, timely, and verifiable information cannot legally be removed, even if it is negative.

Will credit repair improve my credit score?

Credit repair may improve your credit score if disputed items are corrected or removed. However, credit

scores are influenced by multiple factors, including: – Payment history – Credit utilization – Length of credit

history – New credit activity

Results vary, and score increases are not guaranteed.

Is credit repair legal?

Yes. Credit repair is legal and regulated under federal law, including:

– The Fair Credit Reporting Act (FCRA)

– The Credit Repair Organizations Act (CROA)

You also have the right to dispute information on your own at no cost.

The Credit Connect provides

professional assistance, organization, and expertise for clients who prefer guided support.

What do I need to get started?

To begin services, we require:

- A valid government-issued ID

- Proof of address – Access to your credit

reports from all three bureaus - Completion of our onboarding forms and service agreement

Once received, your credit review and dispute process can begin.

How much does Credit Connect service cost?

Pricing varies based on the service package selected. All fees are: – Clearly disclosed before enrollment –

Charged only for services performed – Fully compliant with CROA regulations

For current pricing and package options, please contact us directly or complete the enrollment form.

Will closing accounts help my credit?

Not necessarily. Closing accounts can sometimes lower your credit score, particularly if it: – Increases

credit utilization – Reduces the average age of your accounts

We do not recommend closing accounts without a full credit review and strategic assessment.

Legal Disclosures & Disclaimers

- The Credit Connect does not guarantee the removal of any specific item or any increase in credit

score. - Results vary based on individual credit profiles and creditor responses.

- We do not provide legal or financial advice.

- Clients may dispute credit report information on their own at no cost.

- Services are provided in accordance with the Fair Credit Reporting Act (15 U.S.C. §1681) and the

Credit Repair Organizations Act (15 U.S.C. §1679).

By enrolling, clients acknowledge that no outcomes or timelines are promised or implied.

This site is not affiliated with any major social media platform or its parent company. Additionally, this site is NOT endorsed or sponsored by any social media platform in any way. All platform names and logos are trademarks of their respective owners.

Results may vary, and testimonials are not intended to guarantee or suggest that the same results will be achieved. The Credit Connect provides services to support you on your journey to financial improvement and does not promise specific outcomes.